Deal Terms

The longest post on this website!

Welcome to the Deal!

In commercial real estate leases, understanding deal terms and navigating the lease process can be daunting even for experienced business people, not to mention those that are new to the business.

Contracts have several key requirements that must be met to be valid. These include:

-Offer and acceptance

-Consideration

-Capacity

-Consent

-Lawful purpose

For a more thorough explanation of each one of these elements, see this document from the Government of Canada . I am NOT a lawyer, and you should always seek legal representation when finalizing any business agreement, including lease agreements.

An offer to lease will typically have terms and conditions. The terms are the basic building blocks, and they are the items that are agreed to in the contract and will govern the relationship and obligations of the parties during the agreement.

Conditions are items which must be removed or satisfied for the deal to proceed. Take a look at the following scenario:

- Jerry hereby agrees to sell Bev his 2015 Honda Civic for $15,000 (terms) subject to Bev’s sole satisfactory approval of an independent inspection of the vehicle (condition).

Bev must waive this condition in order for the sale to proceed.

Formal Lease

With leases, there are typically two documents. There will be an initial Offer to Lease or a Letter of Intent (LOI) which outlines deal terms. These agreements are binding and sometimes constitute the final contract between the parties, but most often there will be a second document drafted by the landlord’s lawyer which outlines in detail the obligations of the parties and the steps that must be taken to resolve a breach of the lease or a dispute.

It’s essential to recognize that lawyers are protective of their clients, and as such, the formal lease agreements will almost always be in favor of the landlord. I have clients who have three standard lease agreements for their buildings, one that favors the landlord, one that favors the tenant, and one that is balanced. It’s in the landlord’s best interest to use the strongest lease agreement available to them. While the lease agreement will favor the landlord, if a dispute ends up in court, the courts will tend to favor the tenant, so it’s often in the interest of both parties to resolve any disputes amicably if possible.

Terms for the offer document or LOI should be included in the formal lease document. Formal leases often contain a clause stating that the formal lease constitutes the “entire agreement” between the parties, and will supersede all previous offers or terms that were agreed to, so you must ensure that the terms from the LOI and offer to lease are the same as those contained in the formal lease. Most of the time, when there are differences, this is an error or omission, so having it changed back to the agreed-upon term shouldn’t be a problem.

The lease will go into detail about remedies in case of a breach, what happens if the building burns down etc etc etc… Formal lease agreement will range in length from 4 pages to over 100 pages.

Here are major deal terms you need to be thinking about:

Term

With term, all things are possible. Many landlords look favorably on long term leases, as it gives them long term stability in their properties and is less management intensive than dealing with turnover. Leases can range from a single day, as in the case with some pop-ups to 99-year leases. A typical office lease is between five and ten years.

It’s also important to note, that if you’re a start-up, or have a weak covenant, the long term is by no means reassuring to a landlord. Increasing the term increases how creative the deal can be structured. Depending on the landlord’s time horizon for maturing the asset or potentially exiting the property, a tenant can reach a very favorable agreement with the landlord, which will significantly benefit both parties.

Renewal and Arbitration

Once your primary lease term has elapsed, you may have an option to renew your lease. You will usually have to renegotiate your base rent when this occurs, and you also have the opportunity to add or remove other clauses from the contract. During the renewal, it’s advisable to negotiate a further right to renew as part of the renewal agreement.

If parties aren’t able to agree on base rent, then the lease generally will account for arbitration where a third party, usually an appraiser, will determine market rent for the property and this determination will be binding on both parties. When the tenant exercises this right to renew, the landlord can no longer terminate the agreement. If the tenant misses their window to exercise the right, then they do not benefit from the possible advantages of an arbitration clause. Typically the lease will stipulate when this right has to be used, it can range from 3 months to a full year from the lease expiry, so it’s critical to know when this is coming up.

Lease Rate

I’ve written about lease rates in another article which details gross leases, triple net leases, and everything in between. You can see that article here .

As a tenant and a landlord, what’s critical to understand is

that the face rate of the property impacts the valuation. A below-market lease

has the potential to lower the overall value of the asset, so if possible, it’s

best to negotiate on other terms, such as free rent, or tenant improvement

allowance, so that the building retains its value. This arrangement can create

a win-win for both parties.

If a tenant improvement allowance is desired, it can be good

practice to amortize the value of the allowance into the lease rate. (For

example, if base rates are $14/Sq.Ft, and the tenant wants a $10/Sq.Ft tenant

improvement allowance on a 5 year term, this equates to a $2/Sq.Ft per each

year of the lease so can be covered by increasing the lease rate to $16/Sq.Ft.)

This can help to increase the value of the building to some extent, but if

rental prices are significantly higher than market rents, the banks will take

this into account when it comes time to refinance.

Operating Costs

Again, operating costs are covered in another article . This clause will which costs are the responsibility of each party in the deal.

Conditions

Conditions can be for the benefit of either party and are present in almost every deal we do. A condition gives a party a way out if one of these items can’t be satisfied for any reason. Conditions will have a date attached to them and must be removed before a pre-agreed date for the contract to remain valid.

Typical conditions for the landlord are:

-Review of the tenants financial/corporate covenant

-Board of directors approval

-General contractor estimates for turnkey deals

Common conditions for tenants are:

-Receipt of all necessary licensing and permits for the intended use

-Review and approval of the formal lease

-Lawyer’s review of deal terms and/or the formal lease

-Contractor’s estimates for tenant improvements if the tenant is building out their space

-Board approval

-Blanket “due diligence.”

These are some of the most common conditions, but a condition can be anything as long as the parties mutually agree to it.

Other Clauses

Some of these clauses will eventually get their own articles, but for now, here’s a brief description of some other provisions you may find in a lease agreement.

Early Occupancy and Fixturing

Both of these incentives will occur before the lease commencement date. In the case of fixturing, it’s usually intended for the tenant to build out or otherwise retrofit their space in the time provided. Fixturing is generally, but not always, free of basic and additional rent, but the tenant will have to prove that its insurance is in place prior to being granted possession for the fixturing period.

Early occupancy is almost the same thing, but the purpose of the period is not so explicitly for buildout and improvements, but instead can be opened for business during the early occupancy period. This period is also free of basic and additional rent. I typically recommend using language for early occupancy clauses because it gives the tenant more flexibility with its time.

Free Rent

The free rent period is different than fixturing and early occupancy as it occurs after the lease has officially commenced. Typically this only includes base rent, but sometimes consists of both base rent and operating cost. Landlords will sometime spread the free rent period over the term, to share the risk of this incentive with the tenant.

Tenant Improvement Allowance

Tenant improvement allowance is money paid by the landlord to the tenant to build out its space. This allowance is typically calculated by the square foot ($5 TIA X 10,000 Sq.Ft = $50,000 TIA) but can also be a flat amount.

The allowance is seldom paid to the tenant up-front but will be held by the landlord until the tenant has satisfied some conditions. The most common conditions are that the tenant is still in good standing under their lease agreement, that the landlord inspects the premises and that the tenant makes a statutory declaration that all contractors and sub-trades are paid in full.

Landlord’s/Tenant’s Responsibility

This clause will state who is responsible for various items. The tenant and landlord must assure that these expenses are correct, as you don’t want to be stuck paying for something that wouldn’t usually be your responsibility, such as the landlord paying the tenant’s phone bill.

Signage

This clause will detail who will bear the cost of the production and installation of the signage and will stipulate where signage may be placed on the premises. This ranges from a bronze placard in an office building directory, to fascia and pylon signage, whether window signage on the premises is permitted and this clause can even extend to naming rights for the building.

Landlords will sometimes require that they approve the signage before it’s installed, so if you’re the tenant, you want to ensure that what you’re planning to install is possible. Landlords will have to decide if any given tenant’s signage is following the buildings aesthetic.

Depending on the signage, power consumption may be a consideration. Landlords may also stipulate that tenant’s repair and damage done to the exterior of the building by the installation or taking down of signage.

Parking

The parking clause will outline what parking the tenant is permitted to use, and at what cost. Parking can be a significant concern to some users, especially medical users in the City of Edmonton as the city will require a certain number of stalls to be on site for a given use.

In office buildings, stalls are typically allocated per square foot. If a building has a parking ratio of 2:1000, this means that if you lease 5,000 Sq.ft, you will receive ten stalls. Landlords will occasionally grant more parking for a desirable use (such as a doctors office) and will give them a more favorable parking ratio than other tenants to incentivize them to sign a lease.

Assignment and Subletting (Unreasonably withheld)

If you expect that you might expand your business or be selling your business within your lease term or subsequent renewals, an assignment and subletting clause can be critical in allowing you to do this.

When an assignment/subletting clause says “not to be unreasonably withheld,” this is important. Without this, the landlord can prevent the tenant from subletting or assigning their space for any reason, whether it’s reasonable or not.

With that said, there are situations in which the landlord refusing to assign a lease is not unreasonable. If you’re selling a business and want to assign your lease to the purchaser, some reasons the landlord could reasonably deny the assignment for the following reasons:

-The tenant has bad credit

-The tenant has a criminal record

-The tenant has a high probability of failing in the business they’re taking over

If you outgrow your space and need to sublet it, some reasons the landlord may reasonably restrict your ability to sublet, are as follows:

-The new tenant conflicts with another user

-Restrictive covenants

-Zoning issues

-Environmental issues with the users (drycleaners)

-“Moral” or legal problems with the user

Use

The use clause is where you outline what you will be doing with the space. It may also include your trade name, which is the name your company will be known as to the public.

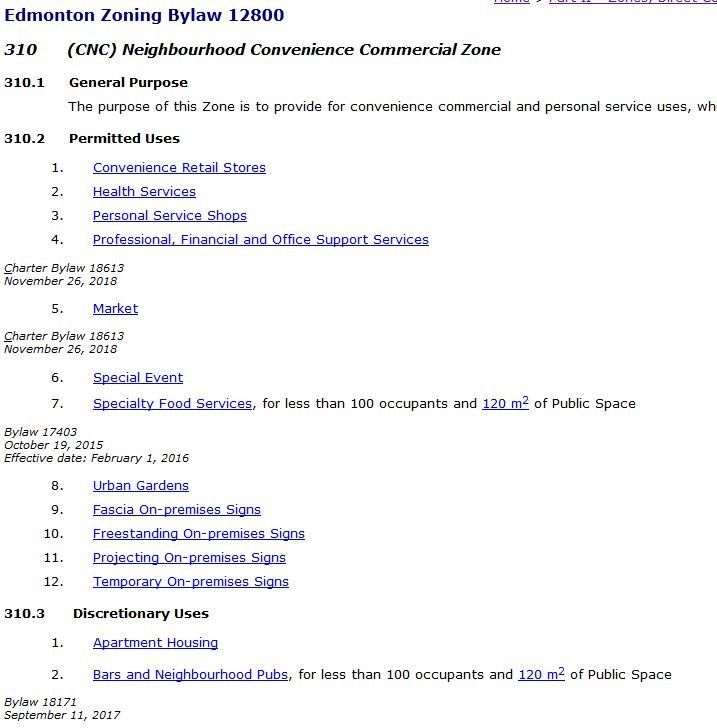

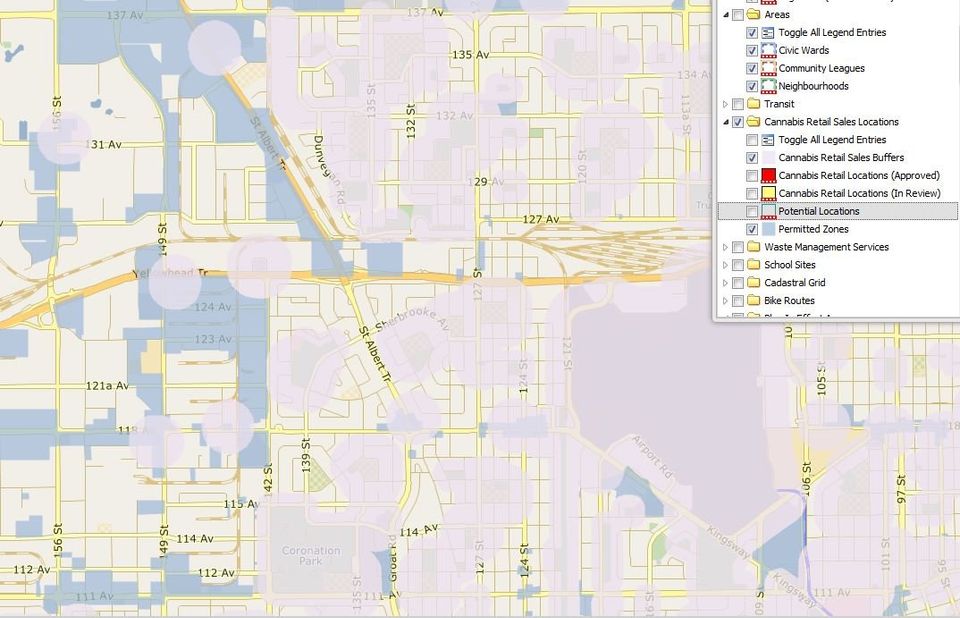

Use is vital to satisfy zoning requirements. In Edmonton, it’s important to know what uses are permitted, discretionary, or not allowed in a particular zoning . If your business doesn’t fit within the zoning it will dramatically increase the amount of time it takes to get city approvals for your business. Sometimes, a company will fit under multiple use categories with the city. If this is the case, it can be advantageous to look at the zoning where you intend to lease, and ensure you select the use that is permitted under that category, rather than discretionary.

Exclusive Use

This protects a user from having other conflicting uses open up shop in the same plaza. If you own a hair salon, you most likely don’t want another hair salon opening up adjacent to you. Exclusive use helps to prevent this, but the clause has to be clear what’s being restricted. If you’re a hair salon, do you need to restrict barbershops or is there a conflict at all? If you’re a Burger QSR, would it be a benefit to restricting pizza users? Donair? It’s essential that the lease stipulates precisely what other uses are limited. If the owner of the building you’re leasing in owns adjacent buildings, you may be able to negotiate that they will also limit competing uses.

Proximity or Radius Clause

This is similar to an exclusive use clause but in the landlord’s interest. This clause is a covenant a tenant makes with the landlord as a promise not to open other locations within a certain proximity. The reason for these clauses is when a landlord collects percentage rent, they don’t want competing sites taking potential profit away from their location.

Franchises and other corporate groups with multiple locations will often impose territories or a radius on their franchisees. This limits the number of sites that can open up in a particular area to help reduce competition. Municipalities will often impose restrictions on specific users to curb competition. In Edmonton, the most well-known example is the 500-meter rule for liquor stores, prohibiting new liquor licenses from being issues to start-ups within 500 meters of an old location. Cannabis retail stores will face similar restrictions.

Deposit

Deposits come in two flavors, there are rental deposits and security deposits.

Rental despots are paid to and held by the landlord once the deal is completed. Usually, these are applied to specified months of rent. There are no rules about how large or small a deposit can be, and I’ve seen deposits range from over half of the value of the lease to there being no deposit at all.

Security deposits work a little differently, they will be held as security by the landlord and not applied to the tenant's rent. Instead, they will be refunded at a pre-determined time, when certain conditions have been met, such as the landlord inspecting the premises for damage upon the tenant terminating the lease.

Personal Guarantees

The landlord may ask for a personal guarantee in addition to, or in lieu of, the deposit. Most of the time, this will apply if the landlord is concerned about the covenant of the tenant, and they want to ensure the tenant has skin in the game. A personal guarantee allows the landlord to pursue more than the corporation in the event the business fails. It’s essential to have a lawyer draw up the paperwork for a guarantee; otherwise there may be issues with enforceability.

There are other forms of indemnity, such as a letter of credit, but personal guarantees are the most common outside of the remedies included in standard formal leases.

Exit Provisions

Exit provisions allow one or both parties to terminate the lease agreement if certain conditions are met. The most common relate the damage to the property which renders it unusable, but there are others.

Demolition or redevelopment clauses will allow the landlord to terminate a tenants lease if they intend to redevelop the property or if they want to do substantial renovations to the premises. These clauses will often leave the tenant with little recourse.

Nuisance clauses are sometimes used as well, although they can be somewhat harder to enforce. Usually, tenants will request that these clauses contain language that the lease can’t be terminated for neighbors complaints if the source of the nuisance is within the normal scope of the business operations. A clause like this may apply to a fitness gym that plays loud music during classes.

Tenants may also have exit provisions for almost any reason, so long as all parties mutually agree on it. Common provisions include terminating the lease if the landlord conducts renovations that disrupt the tenants business. We’ve also written clauses that give tenants an option to terminate their tenancy if operating costs rise over a certain percentage in a year (this was a lease renewal where the landlord had a track record of extraordinary increases year over year).

Shotgun Clause (Another exit provision)

This is an exit provision during the conditional or pending period of the leasing process. This allows the landlord to entertain other offers while the prospective tenant does its due diligence which is never desirable for a tenant but is often better than “no deal” if the tenant requires a prolonged conditional period. Typically, if a landlord exercises this clause, the tenant will have the opportunity to remove its conditions or complete the deal before the landlord accepting the other offer.

First Right of Refusal

Let’s say that you’ve leased space in an office building but are unsure if it’s enough space, so you want an option to lease the adjacent space first before the landlord accepts other offers. This clause gives the tenant the right to match a bona fide offer on a space before the landlord entertains the third party offer. There is typically a tight timeline on this option so that the landlord isn’t handcuffed and is free to consider other deals.

The first right can also apply to the sale of the property if the owner receives an offer on the property within the stipulated timeframe (typically “at any point during the primary lease term or subsequent renewals”).

Options to Purchase

An option to purchase clause gives the tenant the option to buy the property at a predetermined time. Typically the price is not pre-determined and will be determined by mutual agreement. But, I have seen cases where the owner was willing to pre-negotiate the price and sell at the tenant’s option. This is a terrific deal for the tenant, as it transfers risk to the seller. If property values rise, the pre-negotiated price will be to the tenant’s advantage, if prices go down, then this is only an option, and the tenant doesn’t have to exercise this right.

Relocation Clause

A relocation clause can be in favor of the landlord or the tenant. Tenants may request this clause if a more desirable space within their building comes available or if they expand and want to consolidate in the future.

A landlord may want this clause as well to optimize the tenant mix. Relocation is most common in leases in interior malls, and it’s very uncommon to see a landlord relocation clause in other asset classes. The reason for these clauses is percentage rent, by changing a tenant mix, it can create synergies among businesses to increase the mall’s income. Further, if a retailer is underperforming in a valuable, high traffic location, then it gives the mall owner the option to move the tenant to another area in the mall and put a stronger tenant in the prime location.

Morality

Morality clauses are not very common and are most likely to be encountered in older retail assets. The clause essentially allows the landlord to terminate the lease if there’s some question into the activities of the tenant. An example of this would be an “adult” massage business, as businesses like this negatively impact neighboring tenants and the value of the building as a whole.

Insurance

All buildings will require tenant insurance before occupancy. The amount and type of coverage depend on several factors and are best left to a qualified professional. What’s important is that the lease will state how much insurance is required and if the landlord will be named as additional insurance, which is generally the case. It’s usually best to send your insurance provider a copy of the insurance clause in your lease agreement so they can provide coverage accordingly.

This is another expense with your business, so it’s a good idea to factor in this cost when budgeting for your business.

Operating Covenant

This is common in retail leases, where the landlord will want to control what days and what hours their tenants will be open for business. Again, this is in part because of percentage rent, and it also helps promote continuity among businesses operating in a mall or plaza. In leases where operating covenants are in place, there may also be fines for being closed during operating hours.

Recapture Provisions

Recapture provisions can occur in any asset class. This is essentially another landlord exit provision that can be exercised if certain conditions are met. One such situation could be the violation of a proximity clause, if a tenant is underperforming in a location with percentage rent, or is closed for business too frequently, or expresses an intent to sublet or assign the lease. What’s important is knowing what can trigger the clause.

Percentage Rent

Percentage rent is almost exclusively a retail lease consideration. Percentage rent allows a landlord to take a pre-negotiated portion of the tenant’s revenue in a location. This arrangement puts the landlord and tenants interest in close alignment, the situation which will cause issues with this arrangement is when the tenant is underperforming. In these cases, the landlord may terminate the lease or elect to relocate the tenant if it has allowed for this in its lease agreement.

There are lots of ways percentage rent can work, but the most commonly utilized is a “natural breakpoint.” The calculation is similar to a cap rate calculation the way it works is, by dividing the base rental amount by the percentage rent. So if you have a 9% breakpoint and percentage rent on your liquor store, which pays $8,500/month in basic rent, then your breakpoint is $94,444 ($8,500 base rent / 9% percentage rent). Under this arrangement, you would be required to pay the landlord 9% of your sales over $94,444. So if your monthly revenue was $125,000/month, you would pay an additional $2,750 per month in percentage rent ($125,000 revenue - $94,444 breakpoint = $30,556 above the breakpoint, $30,556 X 9% percentage rent = $2,750).

ADR (Alternative Dispute Resolution)

These clauses are sometimes used in cases where there is a high probability of disagreement between parties. A typical lease renewal clause that goes to arbitration is one form of ADR clause, as tenants and landlords almost always disagree on lease rates on renewals.

The purpose of the clause is helping parties reach an agreement in especially difficult or litigious circumstances. Generally, an ADR clause will outline the steps to be taken to resolve a dispute between parties. Often, it will stipulate that parties will seek mediation first, followed by arbitration if mediation fails, in order to avoid litigation. These clauses sometimes include additional penalties if the dispute goes to litigation to serve as a further deterrent to go to court, one such penalty could be that the loser of the lawsuit will pay the winner’s legal fees.

That’s it, my whirlwind tour of lease clauses. If you have any questions or would like additional information, please feel free to contact us .