What is a net lease vs gross lease?

What is a net lease, what is a gross lease? Advantages and disadvantages to both.

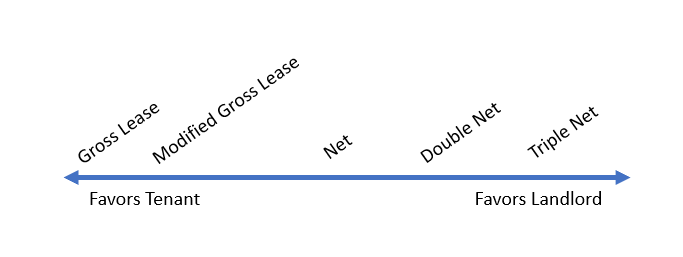

There are two types of lease, gross lease, and net lease. Neither one is better than the other, and both can come into play under different circumstances. As a tenant or a new landlord, it’s essential to understand the differences between them and how these variations can affect operating costs.

Gross Lease

The gross lease is perhaps the most straightforward type of lease, this is the

single figure, one all-inclusive rate that’s charged to the tenant. The

landlord pays all power, water, gas, building insurance, common area

maintenance, etc. This figure may also cover property taxes, which may or may

not be adjusted for tax increases year over year. Gross leases provide the

tenant with predictable expenditure that doesn’t fluctuate and makes for easy

management. The risk to the landlord is that significant increases to

utilities, tax, etc. may all be the responsibility of the landlord, depending

on how the lease is structured.

If a gross lease sounds too good to be true, they’re generally hard to find unless you’re looking at older buildings. Less experienced landlords will often use a gross lease for ease of accounting, but experienced landlords may employ them as well. Usually, newer buildings will tend towards net leases, while older buildings may use a gross lease to make their offering more appealing to low budget users and start-ups.

Net Leases

The “net and care free” lease is at the opposite end of the spectrum. In a net

and care free lease, the tenant is responsible for all expenses related to the

building and will pay directly for property taxes, building insurance,

maintenance, and even the roof. They’re called “net and care free” because they

are carefree to the landlord who simply collects income on its property.

Most leases fall somewhere in the middle of these two extremes. Depending on how spaces are metered, the priorities of the landlord, and the considerations of the landlord’s needs, each lease will be specific. It’s up to the due diligence of the tenant and their agent to determine what costs are reasonable and if it’s standard to what is available in the rest of the market.

As far as other types of net leases, they are as follows:

·Net – Tenant pays property taxes

·Double net – Tenant pays property tax and insurance

·Triple net – Tenant pays property tax, insurance and common area maintenance (CAM)

New buildings tend to be more net because these leases offer the most significant advantages and predictability to the owner.

Operating Costs

It’s crucial to understand operating costs in the context of net leases. Operating costs will cover several different items, and what’s included often depends on the asset class of the building.

TMI (Taxes, Maintenance and Insurance)

Tax

Operating costs almost always include taxes. Most carefree net leases will still charge property taxes to the tenant as an op cost; the reason for this is that the landlord can ensure that property taxes are paid.

Taxes change year over year, and they tend to go up. This cost is passed on to the Tenant, which is why op costs tend to go up every year without fail.

Taxes in Edmonton are determined by the assessed property value. You can see the city’s property taxes here . Depending on the area, taxes can range from $2.50 - $8.00 / Sq.Ft.

Maintenance (CAM)

CAM is “Common Area Maintenance.” This is work charged to the tenant and typically includes such things as landscaping, snow removal, parking lot maintenance, paint, and other services. CAM may also include long term maintenance amortized over the long term. This would be significant capital expenses such as roof-top units (RTUs), boilers, the roof, or other major capital items.

Most reputable landlords budget for large capital expenses and these op costs are generally stable, even if there is an unexpected capital expense. There is a higher risk to tenants in sites where a small local landlord owns the building, and where the landlord may not have budgeted for or even anticipated the expense.

Any building that is undergoing significant renovations may be subject to large fluctuations in op costs. If this is a concern, then it can be advisable to talk to other tenants in the building to see how the landlord has managed operating costs before signing a lease.

Insurance

The landlord’s building insurance is usually charged back to the tenant as well. It’s important to know that buildings generally have multiple layers of insurance. In a condominium, the condo corporation will have insurance, the owners of the units will have separate insurance, and the tenants will be required to have tenant insurance in place before being granted possession.

If you’re a start-up business or want a change of insurance for a new location, your broker will be able to connect you with a reputable insurance provider. Tenant’s insurance will be defined in the formal lease, and often you can send your insurance provider a copy of the insurance clause from the contract, and they will be able to provide coverage accordingly.

Utilities

Utilities are reasonably self-explanatory. There are three utilities – power, water, and gas (heat).

Depending on the space, different utilities may be included in the operating costs. In industrial buildings, services are usually metered separately to avoid disputes between the landlord and the tenants about power usage.

Consider, as an example, a fabrication shop. A fabrication business will use more power than their neighbors so their power consumption should be monitored to ensure costs are changed reasonably to tenants.

Another heavy power user is a server farm or data center. These users draw considerable power, not only for the operation of their equipment but also the high cost in keeping the servers cool with HVAC.

In older buildings, or in buildings that have been demised into smaller spaces since they were built, utilities may be on a single meter. When this happens, it is possible for the landlord to install a check meter to monitor the tenant’s use separately. Check meters are generally inexpensive and are an economical alternative to separately metering a space. The same can often be done for water consumption.

When signing a lease, it’s imperative to understand which services are included in the lease and if the spaces are separately metered or on a single meter. Retail and industrial users are often separately metered while office buildings tend to be on a single meter since differences in consumption of utilities are minimal.

For office users, one consideration to take into account is HVAC hours in a building. While the cost of HVAC is included in the op costs, it may not cover the price if you need HVAC outside of building hours. In many buildings, hours will run from 8:00 am to 6:00 pm, and they will not run HVAC outside of these hours unless there is a special agreement with the tenant. As a tenant, you need to know ahead of time if this will be at an additional cost.

In-Suite Janitorial

This will typically only apply to leases in office buildings. Operating costs can include cleaning, daily, weekly or monthly. In office towers, this generally is an assumed service. Exceptions may occur for users with security concerns, in which case high-security janitors would have to be employed at additional cost.

In buildings where only a few tenants require cleaning, the cost of in-suite janitorial can be high, because they don’t benefit from the economies of scale that are present in office towers. Another consideration is users, such as orthodontists that produce a lot of dust, but may still occupy a medical or office building. These users may pay additional cleaning costs to cover the extra work.

Different Practices by Asset Class

Every commercial lease is different, and it’s the responsibility of the tenant to understand what they’re signing up for when they sign a lease.

There are some general differences between these asset classes which are predictable.

Industrial properties tend to lean more toward net leases. Operating costs will include TMI, but they tend not to include utilities.

Retail properties are much the same but are more likely to include utilities than industrial spaces. Restaurants are more likely to be separately metered because of the requirement for services.

Office properties tend to include TMI and utilities. In office towers, in-suite janitorial is likely to be included in these costs as well.

Interested in learning more about office leases? Read our article on the Gross-Up factor .