How do leaseback sales work

A taste of the mechanics

So you’ve decided to sell your property as a leaseback. How does this work?

Well, let’s take an example from a previous article and expand on it.

Sally owns a physiotherapy practice she’s been operating for the past 15 years and is ready to get out of the business. She was prudent when selecting business partners, and one of those partners is prepared to buy her out of the business, and continue operating.

Sally owns the real estate as well and wants out of it.

Sally’s partners see value in the location and plan to stay there long term if the lease rate is in line with the market.

The property has the following specifications:

- Freestanding 5,000 sqft building in a secondary market

- The property’s exposure is good, but more importantly, there’s ample off-site parking available to customers at no cost.

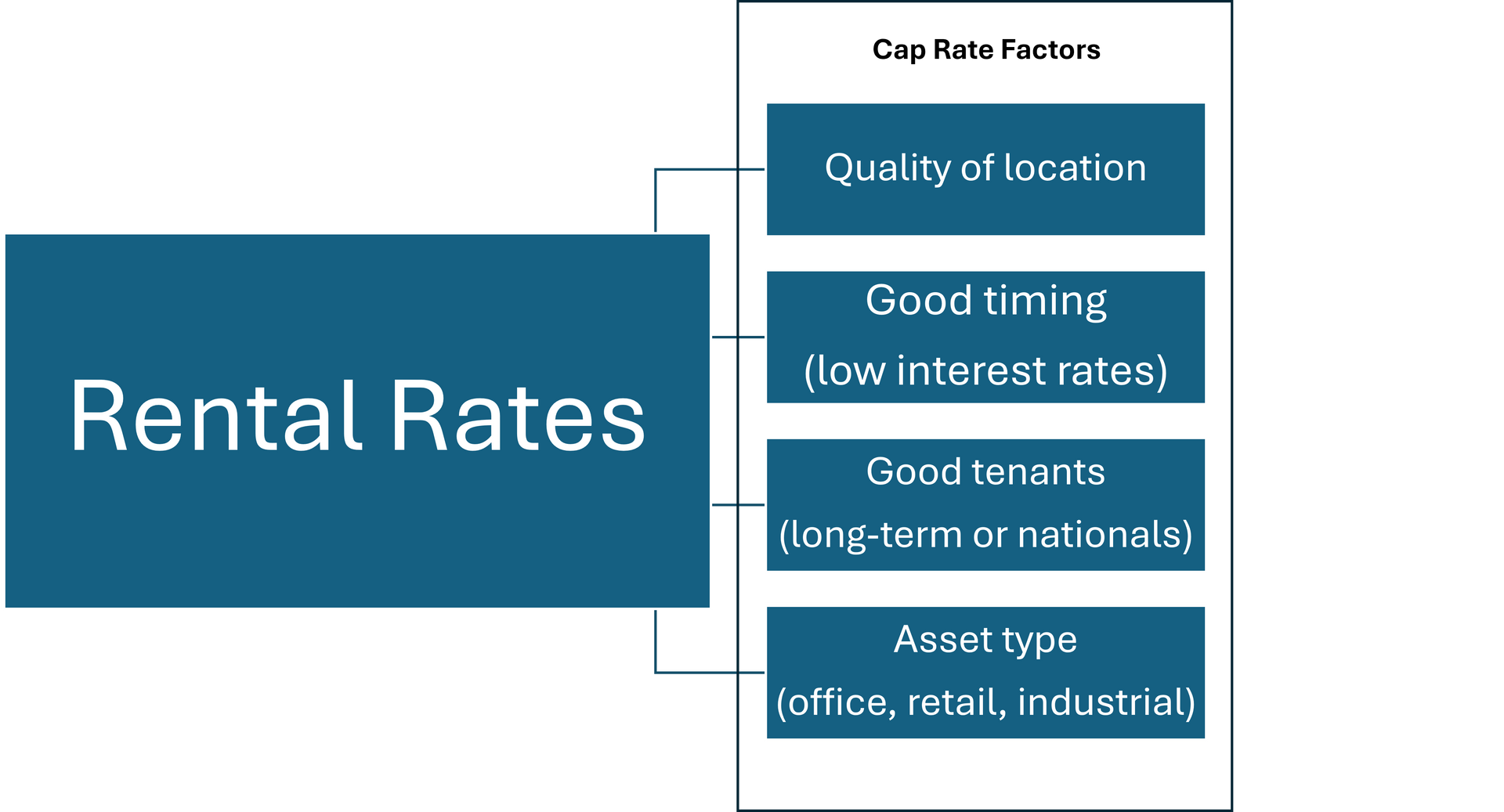

- Market lease rates for a property like this range between $14 - $18 per square foot on a net rental basis.

- Because Sally owns the property and the business, the lease rates she paid to herself were $20 per square foot to facilitate faster debt paydown.

- Most building systems are in good condition.

- Market cap rates in Sally’s market hover around 7%

At first, Sally hopes to achieve $1,425,000 for the property based on her current lease rates, but after speaking with her banker and a real estate agent, she decides to list the property for $1,285,000.

After some time on the market and some excellent advertising, she receives an offer for $1,142,000 if the company leases back the property for 10 years at $18 net (7.8% cap rate).

After some back and forth, they reach an agreement to purchase the property for $1,195,173, and the company will leaseback the property for 10 years at a rate starting at $16 and escalating to $19 over the 10 year term (6.69% cap rate to 7.95% cap rate).

After a couple of months of hard work and review, an agreement is reached, and the deal closes. The physio company goes on with business as usual, and the investor is getting a healthy return on his capital, and Sally finances the next chapter of her life.

This is one way a leaseback transaction can go, and is a vanilla example. The reality of a trade like this can be much more complicated but is well suited to address complex scenarios with multiple ownership levels.

Our team has navigated this process from deals for $450,000 to $12m. We’re always happy to discuss the possibility of a sale-leaseback with owners.